Services for Franchisees

New Ink Consulting works with franchisee candidates to develop bank-ready business plans, recommends optimal loan structures, secures capital and advises the client on necessary documents for the loan application. The company has a 99% success rate in getting loans approved.

Benefits of the Business Plan

The plans reveal insights such as:

Two Components to the Plan

Working Collaboratively

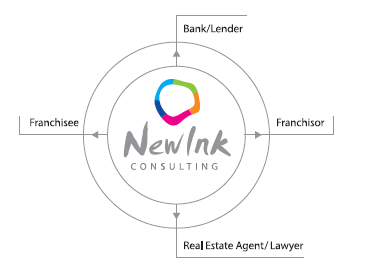

New Ink Consulting acts as the “glue” between the franchisor, franchisee candidate, commercial real-estate agent, lawyer and bank to collect and analyse all the information. With insights from current franchisees in terms of past performance, projections are based on real-world results.

Valuations

New Ink Consulting prepares valuations on behalf of buyers and sellers. Where relevant, the valuation examines the difference between the break-even cost on the existing establishment and the investment on developing a franchise from scratch to evaluate the transaction value.

New Ink Consulting works with franchisee candidates to develop bank-ready business plans, recommends optimal loan structures, secures capital and advises the client on necessary documents for the loan application. The company has a 99% success rate in getting loans approved.

Benefits of the Business Plan

The plans reveal insights such as:

- How much start-up capital will be needed to open the doors?

- Once up and running, what are the monthly working capital needs?

- What’s the revenue potential given the population and competition?

- What’s the return on investment?

Two Components to the Plan

- A written portion that illustrates the opportunity by analysing industry metrics, consumer behaviour, competitive players, and site location dynamics. Implications derived from this research highlight brand differentiation, marketing approaches and help inform assumptions for the financials.

- A 5 year financial projection including cash flow, income statement, opening balance sheet, loan schedule and depreciation table (as well as any ratios the specific bank requires, such as debt servicing ratios).

Working Collaboratively

New Ink Consulting acts as the “glue” between the franchisor, franchisee candidate, commercial real-estate agent, lawyer and bank to collect and analyse all the information. With insights from current franchisees in terms of past performance, projections are based on real-world results.

Valuations

New Ink Consulting prepares valuations on behalf of buyers and sellers. Where relevant, the valuation examines the difference between the break-even cost on the existing establishment and the investment on developing a franchise from scratch to evaluate the transaction value.